In an increasingly digital financial landscape, the fusion of artificial intelligence with trading strategies has transitioned from experimental to essential. One of the notable platforms at the forefront of this evolution is iCryptoX.com. As of 2025, this platform has gained significant traction by implementing advanced machine learning techniques to offer practical and result-driven trading applications. This article explores how iCryptoX.com utilizes machine learning to revolutionize trading — enhancing prediction accuracy, optimizing portfolio management, and mitigating risk.

TL;DR

iCryptoX.com is leveraging advanced machine learning models to deliver highly accurate, adaptive, and automated trading tools for both institutional and retail investors in 2025. These innovations include predictive analytics, real-time risk assessment, and smart portfolio allocation that significantly outperform traditional models. By integrating deep learning, NLP, and reinforcement learning, iCryptoX.com empowers traders with data-driven insights. Their system exemplifies the practical use of AI in actual trading environments, dramatically enhancing decision-making capabilities across the board.

The Practical Evolution of Machine Learning in Trading

Machine learning in financial markets isn’t new, but its practical application has matured immensely. By 2025, platforms like iCryptoX.com have evolved past the sandbox stage, offering robust tools that operate in real-time and adapt to volatile market conditions. The key areas where machine learning now plays a critical role include:

- Price Trend Prediction and Signal Generation

- Portfolio Optimization and Asset Allocation

- Risk Management and Anomaly Detection

- Sentiment Analysis and NLP-Driven Trading

Each of these pillars is grounded in iCryptoX.com’s platform infrastructure, powered by data pipelines, custom algorithms, and cloud-based model deployment. These developments allow users to execute trades backed by in-depth analysis and mathematical precision.

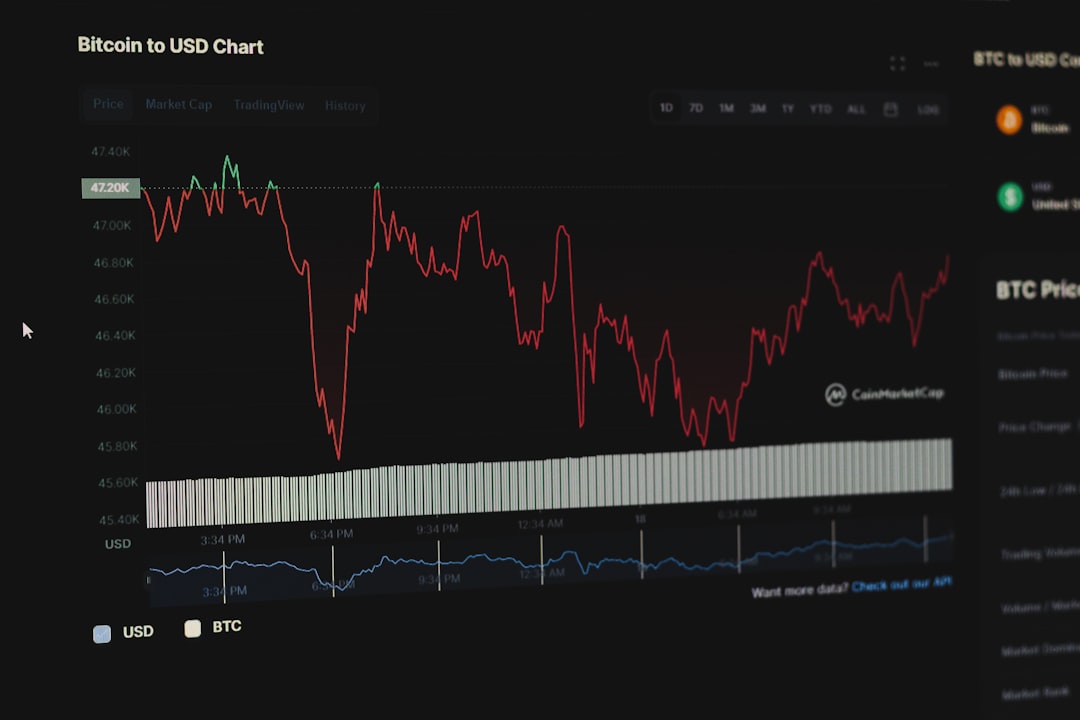

Predictive Analytics: The Heart of Smart Trading

iCryptoX.com’s predictive analytics system utilizes a hybrid approach, combining supervised learning algorithms such as random forests and gradient boosting with deep learning neural networks. These models analyze historical price data, volume, macroeconomic indicators, and alternative datasets like social media sentiment and blockchain transaction flows.

For instance, the platform’s future price estimation model evaluates multiple timeframes and volatility clusters, providing not just directional predictions but confidence intervals on forecasted asset prices. These insights help traders make more informed choices about entry and exit points.

A standout feature is the system’s adaptive learning loop: models are continuously retrained using the latest data, allowing them to improve accuracy over time. In contrast to manual trading strategies, iCryptoX.com’s automated predictions remove emotion and bias from the equation while retaining flexibility.

Reinforcement Learning and Strategy Adaptation

One of the platform’s most transformative innovations in 2025 is its use of reinforcement learning (RL) for dynamic strategy adjustment. RL-driven agents observe market changes and adjust their actions based on the rewards (profitability, drawdown minimization, etc.) they receive.

These agents follow algorithms like Proximal Policy Optimization (PPO) and Deep Q-Networks (DQN) to make real-time decisions using both short- and long-term objectives. For instance, a trading bot trained on RL will not just react to price movements but anticipate counterparty behaviors and regulatory risks based on live news sentiment and cross-market signals.

Natural Language Processing: Mining Alpha from News

Another domain where iCryptoX.com excels is natural language processing (NLP) applied to financial news and social media. Its proprietary NLP pipeline processes thousands of textual sources daily — including tweets, regulatory reports, macroeconomic updates, and influential financial blogs.

By applying named entity recognition and sentiment analysis models like BERT and GPT-based transformers fine-tuned for finance, the system gauges the tone, urgency, and potential impact of each news item.

This allows users to benefit from sentiment-driven market predictions — a necessity in the crypto market where public perception can move prices dramatically in short periods.

Users can customize filters to exclude noise and prioritize reputable sources. Combining this with real-time execution systems, iCryptoX.com enables predictive news-trading strategies that are often faster than human traders can comprehend and act upon the information.

Portfolio Optimization with AI

In 2025, investors no longer assign asset weights in portfolios manually. Instead, iCryptoX.com uses genetic algorithms and convex optimization combined with ML forecasts to continuously rebalance assets based on performance expectations, correlation, and risk tolerance.

These models assess:

- Expected returns and volatility using historical VAR models enhanced by ML

- Market regime shifts using hidden Markov models

- Geopolitical, regulatory, and macroeconomic event probabilities from NLP systems

By leveraging this real-time information, the portfolio management system provides recommendations or can autonomously execute rebalancing to improve Sharpe Ratio, Sortino Ratio, and overall risk-adjusted returns.

Risk Management in Real-Time

One of the biggest challenges in crypto trading has been real-time risk management. iCryptoX.com addresses this via advanced ML techniques, such as anomaly detection using autoencoders and Bayesian networks that model potential system failures or irregular trading behaviors.

Traders are alerted about:

- Sudden volume spikes that precede market manipulation

- API anomalies suggesting data integrity breaches

- Potential arbitrage opportunities with minimal risk

Moreover, the ML system can simulate stress scenarios — such as sudden regulation changes or major hacks — and backtest the user’s current strategy against these scenarios. This enables institutional clients to apply proactive adjustments in milliseconds, far faster than any manual intervention could match.

Regulatory Compliance and Transparency

In 2025, increasing regulatory scrutiny of AI-based trading systems has made compliance a core priority. iCryptoX.com ensures full transparency through its explainable AI (XAI) modules, allowing users and regulators to understand the rationale behind trade decisions.

Audit trails, decision trees, and model rationale summaries are generated for each significant trade, ensuring users meet compliance mandates such as those set by the SEC, ESMA, and local crypto regulators. These efforts position iCryptoX.com not only as a technology leader but also as a trust-first trading solutions provider.

Future Trends Beyond 2025

As AI becomes further intertwined with finance, iCryptoX.com is exploring additional innovations to stay ahead of the curve:

- Quantum machine learning models for ultra-fast optimization problems

- Integration with decentralized finance (DeFi) ecosystems for on-chain AI models

- Emotion-aware bots that adjust psychological risk profiles on the fly

These developments signal a greater shift toward autonomous trading environments where machines continue learning, adjusting, and even negotiating trades on behalf of users in a decentralized ecosystem.

Conclusion

The practical applications of machine learning on iCryptoX.com in 2025 represent not just advancements in technology but shifts in financial philosophy. Traders are no longer alone in their decisions — they are now equipped with sophisticated, explainable, and continuously learning AI companions.

Whether you’re a novice exploring crypto markets or an institutional investor managing billions, iCryptoX.com’s innovative use of ML technologies offers tools that are proactive, personalized, and designed for tomorrow’s financial ecosystem.

In the trading world of 2025, data isn’t just misunderstood noise — it’s intelligent action. And with platforms like iCryptoX.com, every action is a step ahead.